HIV & Advanced Care Planning

Advance care planning is the process of thinking about, talking about and planning for future health care and end of life care. It helps you, the important people in your life and your health care team know what health care you want or don't want.

Nobody really wants to think about the end of their life, but knowing what to include in your plans is a good place to start. This section provides information about things to think about and plan for, such as Palliative Care, Wills and Estate Planning.

Quicklinks:

What is advance care planning and why is it important?

Advance care planning is an ongoing process of thinking about your future health care and talking about this with your family/whānau and your healthcare team. This includes planning your end-of-life care.

Planning your future health care helps you understand what the future might hold. It also helps your family/whānau and your healthcare team know what health care you would or would not want, which is especially helpful when you can no longer speak for yourself, eg, in advanced stage of dementia or when a sudden unexpected illness happens.

While 60% of people say that making sure their family is not burdened by tough decisions is “extremely important”, 56% have not communicated their end-of-life wishes. Source: Survey of Californians by the California HealthCare Foundation, 2012

Advance care planning is a voluntary process, the pace and content of the conversations is determined by you. Your healthcare team will make sure you have enough information in a way you can understand it, so that you can more effectively take part in medical decision-making processes now and in the future.

The Health Quality & Safety Commission New Zealand have some useful information of Advance Care Planning.

Planning your future health care helps you understand what the future might hold. It also helps your family/whānau and your healthcare team know what health care you would or would not want, which is especially helpful when you can no longer speak for yourself, eg, in advanced stage of dementia or when a sudden unexpected illness happens.

While 60% of people say that making sure their family is not burdened by tough decisions is “extremely important”, 56% have not communicated their end-of-life wishes. Source: Survey of Californians by the California HealthCare Foundation, 2012

Advance care planning is a voluntary process, the pace and content of the conversations is determined by you. Your healthcare team will make sure you have enough information in a way you can understand it, so that you can more effectively take part in medical decision-making processes now and in the future.

The Health Quality & Safety Commission New Zealand have some useful information of Advance Care Planning.

What is an advance care plan?

An advance care plan is a written record that includes all your wishes, preferences, values and goals relevant to all your current and future medical care, that has been written after discussion with your family/whānau and your healthcare team. The plan can be very helpful especially if something unexpected suddenly happens or when you become very unwell, as you may not be able to express your wishes and thoughts at the time.

An advance care plan can include things like:

An advance care plan can include things like:

- who your family members/whānau or pets are (who you consider your family/whānau might not be a relative, but rather your partner or friends)

- your values, spiritual and emotional needs

- the ways you would like those caring for you to look after you

- the type of funeral you would like

- where your important papers and documents are

- whether you have an enduring power of attorney (EPOA) or advance directive – enduring power of attorney is someone you appoint legally to make decision on your behalf about your personal and financial matters when you can no longer speak for yourself.

Introduction to advance care planning

Introduction to advance care planning

Advance Care Planning Checklist

Advance Care Planning Checklist

Start discussions early with your loved ones, while everyone can still help make decisions

Create documents that communicate your healthcare, financial management and end of life wishes for yourself and the people you care for, with legal advice as needed

Review plans regularly, and update documents as circumstances change

Put important papers in one place. Make sure a trusted family member or friend knows the location and any instructions

Make copies of healthcare directives to be placed in all medical files, including information on all your doctors

Give permission in advance for a doctor or lawyer to talk directly with a caregiver as needed

Reduce anxiety about funeral and burial arrangements by planning ahead

Start discussions early with your loved ones, while everyone can still help make decisions

Create documents that communicate your healthcare, financial management and end of life wishes for yourself and the people you care for, with legal advice as needed

Review plans regularly, and update documents as circumstances change

Put important papers in one place. Make sure a trusted family member or friend knows the location and any instructions

Make copies of healthcare directives to be placed in all medical files, including information on all your doctors

Give permission in advance for a doctor or lawyer to talk directly with a caregiver as needed

Reduce anxiety about funeral and burial arrangements by planning ahead

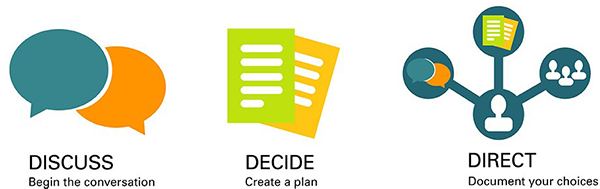

What is involved in advance care planning?

Thinking about

The first step in advance care planning is thinking about what matters to you and what you would like for your future health care. This can include things like:

- your values and beliefs

- treatments or care you would want if certain things happen

- medical problems you might have in the future

- how you would want to be involved in your treatment decisions

Talking about

Once you have thought through some of the issues, you will have a series of conversations with both your family/whānau and your healthcare team to discuss your future health care. Make sure you have the time and opportunity to ask your questions and to express your preferences for end-of-life care. These conversations are important even if you never write down an actual plan.

Read more about talking about your future health care.

Read more about talking about your future health care.

Planning for

It's a good idea to write down your wishes when you have thought through things and discussed them with your family/whānau and your healthcare team. This can help others be clear what you would and would not want in certain situations. They can also refer to your plan if you can’t speak your yourself. Having your wishes put down in writing can save families/whānau and healthcare teams a lot of worry and concern. It can be seen as a gift to your loved ones if and when they have to make a decision on your behalf.

Sharing

If you have a plan written down, make sure you share it with your family/whānau and your healthcare team and anyone else you would like to share it with. It is important your whānau and other loved ones know you have a plan and where the plan is kept. Or you can give them a copy.

My advance care plan and guide teaches and guides you in what you need to think about and how to write an advance care plan. You can do this with your family/whanau and healthcare team or do it yourself and then share it with them. There is also an electronic version of my advance care plan that you can complete online and email your family/whānau.

My advance care plan and guide teaches and guides you in what you need to think about and how to write an advance care plan. You can do this with your family/whanau and healthcare team or do it yourself and then share it with them. There is also an electronic version of my advance care plan that you can complete online and email your family/whānau.

Reviewing

It's important to review your plan regularly to make sure nothing has changed for you. You can also add things to your plan as often as you like and change your decisions at any time. Every time you make a change, let your healthcare team and anyone who has a copy of your advance care plan know.

End of Life Choice Act 2019

End of Life Choice Act 2019

From 7 November 2021 people who experience unbearable suffering from a terminal illness will be able to legally ask for medical assistance to end their lives.

The introduction of assisted dying means that a person with a terminal illness who meets the eligibility criteria can request medication to relieve their suffering and end their life. It is important to note that HIV alone is NOT considered a terminal illness.

To be eligible for assisted dying under the Act, two doctors must agree that a person meets, and continues to meet throughout the application process, all of the following criteria:

The introduction of assisted dying means that a person with a terminal illness who meets the eligibility criteria can request medication to relieve their suffering and end their life. It is important to note that HIV alone is NOT considered a terminal illness.

To be eligible for assisted dying under the Act, two doctors must agree that a person meets, and continues to meet throughout the application process, all of the following criteria:

- be aged 18 years or older;

- be a citizen or permanent resident of New Zealand;

- have a terminal illness that is likely to end their life within six months;

- be in an advanced state of irreversible decline in physical capability; and

- be experiencing unbearable suffering that cannot be relieved in a way that is acceptable to them.

The Act sets out the legal framework and a high-level process for accessing assisted dying, including strict eligibility criteria and safeguards.

An important safeguard to be aware of, is that the onus is on you to make an explicit request for help to die. Doctors are prohibited from raising assisted dying as an option unless you first make the request and initiate the dialog.

Assisted dying is not a replacement for palliative care or health care services more generally. It provides another option for people with a terminal illness in certain circumstances.

Further information on assisted dying and the eligibility criteria can be found here.

An important safeguard to be aware of, is that the onus is on you to make an explicit request for help to die. Doctors are prohibited from raising assisted dying as an option unless you first make the request and initiate the dialog.

Assisted dying is not a replacement for palliative care or health care services more generally. It provides another option for people with a terminal illness in certain circumstances.

Further information on assisted dying and the eligibility criteria can be found here.

Palliative Care

Palliative Care

Palliative Care is care for a person of any age who has a life-limiting illness. It involves supporting and helping the person to live as comfortably and fully as possible.

- A ‘life-limiting illness’ is one that cannot be cured and may at some time result in the person dying (whether that is years, months, weeks or days away).

- Palliative care involves providing assistance at all stages of the life-limiting illness.

- It can be provided by all health care professionals, including GPs and district nurses – supported where necessary by specialist palliative care services.

- Hospices are the main providers of specialist palliative care services for people living in the community.

Palliative Care aims to ensure best quality of life

- Provides relief from pain and other forms of distress

- Integrates psychological, spiritual and physical aspects of care

- Offers support to live as actively as possible - includes family and friends

- Symptom management: including pain

- Psychosocial and Spiritual support; including changing family dynamics, stigma, loss of functions, loss of income, mental health changes

- End of life and bereavement counselling

- Interdisciplinary team; Medical, Social workers, Psychotherapists, Pastoral counselling

Wills and Estate Planning

Why have a will?

Wills are mostly created to list the family members that you want to provide for if you pass away and how you want to divide up what you own.

Wills can also be used to determine who you would like to look after your children or pets should the unthinkable happen. Although an incredibly sad scenario to think about, it is so beneficial to know exactly how you would like them cared for.

Wills can also be used to outline if you would like to leave meaningful gifts or items to people or organisations of your choice. Many people leave donations to charities and causes close to their hearts.

Finally, wills can also list the arrangements for your funeral and what person you would like to carry these out. This is important to think about if some family members have questionable music or floral arrangement tastes.

If you don't have a will, or for one reason or another it is not valid, then your final wishes may not properly come to fruition and it could potentially put your family into legal or financial difficulties.

Wills can also be used to determine who you would like to look after your children or pets should the unthinkable happen. Although an incredibly sad scenario to think about, it is so beneficial to know exactly how you would like them cared for.

Wills can also be used to outline if you would like to leave meaningful gifts or items to people or organisations of your choice. Many people leave donations to charities and causes close to their hearts.

Finally, wills can also list the arrangements for your funeral and what person you would like to carry these out. This is important to think about if some family members have questionable music or floral arrangement tastes.

If you don't have a will, or for one reason or another it is not valid, then your final wishes may not properly come to fruition and it could potentially put your family into legal or financial difficulties.

Getting a will

If you don't have a will yet, or feel you need to update your current one, it’s good to know you have a few options. You could firstly get one drafted by someone with experience, such as a lawyer or trustee company.

It is also good to know that wills do not have to have a high cost association with them. It could pay to 'shop around' to find out your options. A will must also be signed and witnessed. If the proper procedures are not followed, a will may not be valid.

Some possible options are:

It is also good to know that wills do not have to have a high cost association with them. It could pay to 'shop around' to find out your options. A will must also be signed and witnessed. If the proper procedures are not followed, a will may not be valid.

Some possible options are:

- New Zealand Will Kit ($25.00)

- Footprint ($100 one off fee)

- Law Depot (They have a free NZ will kit)

What should a will cover?

Some things to think about including in your will are:

- Your partner, children, grandchildren, other family members or friends you want to provide for

- Any family trust that you wish to leave property, money or other assets to

- Specific bequests such as cash payments, jewellery, artwork or furniture you want to leave to particular family members or friends

- Any charities or organisations you may want to leave money to

- Details of how you would like your funeral to be carried out

Who should be involved

Your will needs both an executor and a trustee.

An executor obtains probate from the court – probate is a certificate from the High Court approving the will and authorising the executor to deal with the estate assets.

The trustee then carries out the wishes you have in your will after you die.

It is good to know you can actually appoint a family member as the executor and the trustee – even if they are going to benefit from the will.

An executor obtains probate from the court – probate is a certificate from the High Court approving the will and authorising the executor to deal with the estate assets.

The trustee then carries out the wishes you have in your will after you die.

It is good to know you can actually appoint a family member as the executor and the trustee – even if they are going to benefit from the will.

When you may need to check/change your will?

Changes in your life can mean that your will is not the most up-to-date. You may need to have a think about if it is relevant to your current age and stage of life. Some of the key life milestones, like having a baby, or getting married are good times to check in on your will, and whether it is still what you want to happen.

Work & Income Funeral Grant

Work & Income Funeral Grant

A Funeral Grant can help with some of the funeral costs of someone who has died. More info can be found here.

Who can get it

You may be able to get a Funeral Grant if someone has died and you are either their:

Who can get it

You may be able to get a Funeral Grant if someone has died and you are either their:

- partner

- child, or

- parent/guardian (if they are under 18).

Income and assets

If you are the deceased person's partner or parent/guardian, it will also depend on your income and assets.

It will also depend on the deceased person's assets too.

When you can't get a Funeral Grant

Funeral costs can also be covered by:

If you are the deceased person's partner or parent/guardian, it will also depend on your income and assets.

It will also depend on the deceased person's assets too.

When you can't get a Funeral Grant

Funeral costs can also be covered by:

- another organisation, eg, ACC or Veteran's Affairs

- prepaid funeral cover.

Join Body Positive

By becoming a member you will be able to access all the services we offer, as well as support and updates to help you live better.

Newsletter

Want to be keep up with whats happening at Body Positive?

Subscribe to our newsletter below by submitting your e-mail address.

Subscribe to our newsletter below by submitting your e-mail address.